Fixed vs. Graduated vs. Interest-Only Mortgage Amortization

When selecting a mortgage, one of the most critical decisions is choosing the right amortization schedule. This choice significantly impacts your monthly payments and the total interest you’ll pay over the life of the loan. Here, we’ll compare three common amortization options: fixed, graduated, and interest-only.

When selecting a mortgage, one of the most critical decisions is choosing the right amortization schedule. This choice significantly impacts your monthly payments and the total interest you’ll pay over the life of the loan. Here, we’ll compare three common amortization options: fixed, graduated, and interest-only.

Fixed Amortization

A fixed amortization mortgage offers predictable monthly payments that remain constant throughout the loan term. This stability makes budgeting easier and provides peace of mind, knowing your payment won’t increase unexpectedly. Fixed amortization is ideal for those who plan to stay in their home long-term and prefer a straightforward, predictable payment schedule.

Pros:

- Consistent monthly payments

- Easier budgeting

- Lower overall interest costs compared to graduated or interest-only options

Cons:

- Higher initial monthly payments compared to graduated or interest-only loans

Graduated Amortization

Graduated amortization mortgages start with lower monthly payments that gradually increase over time. This structure can be beneficial for individuals expecting their income to rise in the future. It allows you to start with manageable payments that grow as your financial situation improves.

Pros:

- Lower initial monthly payments

- Payments increase as income potentially increases

- Can make homeownership more accessible for those early in their careers

Cons:

- Higher total interest costs over the life of the loan

- Payments can become challenging if income growth doesn’t meet expectations

Interest-Only Amortization

Interest-only mortgages allow borrowers to pay only the interest for a specific period, typically 5-10 years, after which they begin paying both principal and interest. This option is attractive for those who want the lowest possible initial monthly payments or who plan to sell or refinance before the interest-only period ends.

Pros:

- Lowest initial monthly payments

- Frees up cash flow for other investments or expenses

- Can be beneficial for short-term ownership or investment properties

Cons:

- No principal reduction during the interest-only period

- Significant payment increase after the interest-only period

- Higher overall interest costs if the loan is held long-term

Making the Right Choice

Choosing the right amortization schedule depends on your financial situation, long-term goals, and risk tolerance. A fixed amortization mortgage offers stability and lower overall interest costs, making it ideal for long-term homeowners. Graduated amortization provides initial affordability with increasing payments, suitable for those expecting future income growth. Interest-only loans offer the lowest initial payments but come with the risk of higher payments later.

Before deciding, give me a call to evaluate which option aligns best with your financial strategy and homeownership goals.

When you first opted for a reverse mortgage, it might have felt like the perfect solution to tap into your home equity and enjoy your retirement without monthly mortgage payments. As time passes, your financial situation, goals, or the market itself can change, making you wonder: “Can I refinance my reverse mortgage?” The answer is yes, but it’s essential to understand what is involved before making a move.

When you first opted for a reverse mortgage, it might have felt like the perfect solution to tap into your home equity and enjoy your retirement without monthly mortgage payments. As time passes, your financial situation, goals, or the market itself can change, making you wonder: “Can I refinance my reverse mortgage?” The answer is yes, but it’s essential to understand what is involved before making a move. The real estate market can be a bit confusing, especially when you encounter terms like “pending” and “contingent” deals. Understanding these terms is crucial whether you’re a buyer or a seller, as they can significantly impact the progression of a property transaction.

The real estate market can be a bit confusing, especially when you encounter terms like “pending” and “contingent” deals. Understanding these terms is crucial whether you’re a buyer or a seller, as they can significantly impact the progression of a property transaction. Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation.

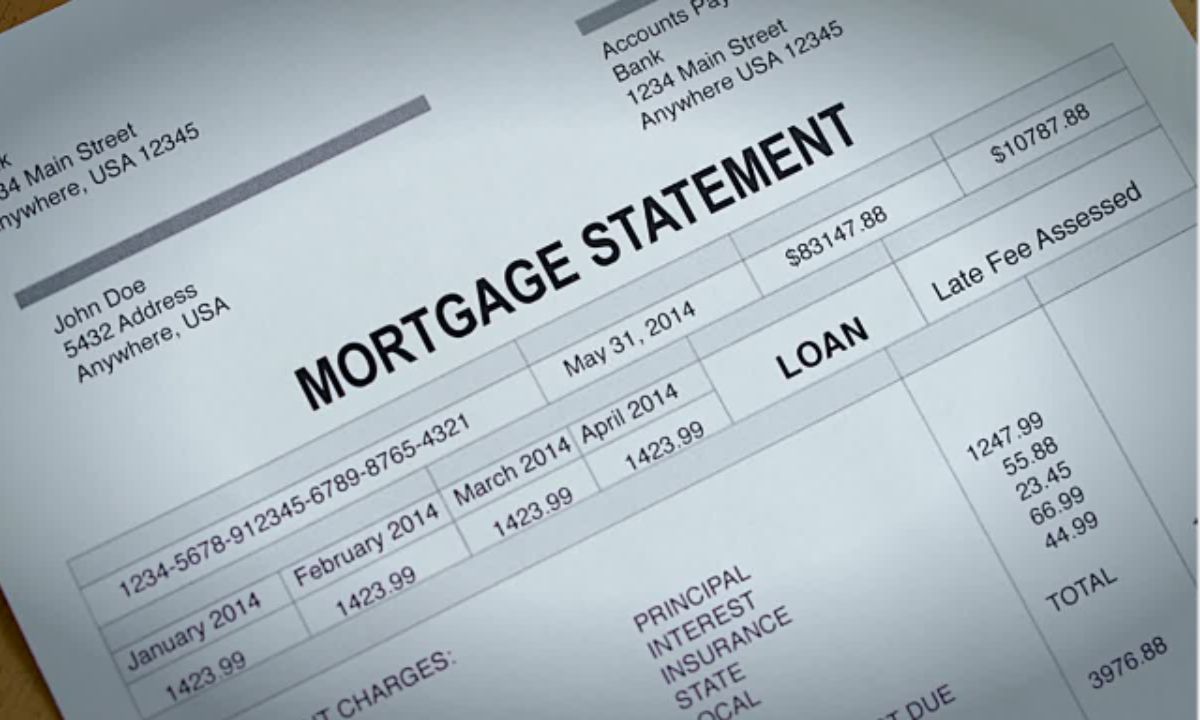

Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation. Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when reading your mortgage statement, what to look for, and how to verify its accuracy.

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is a list to help guide you when reading your mortgage statement, what to look for, and how to verify its accuracy.