The Pros and Cons of buying new VS Pre-Owned

Buying a home is a significant investment, and one of the most important decisions to make when buying a home is whether to purchase a new or pre-owned property. Here are some pros and cons of each option:

Buying a home is a significant investment, and one of the most important decisions to make when buying a home is whether to purchase a new or pre-owned property. Here are some pros and cons of each option:

Pros of buying a new home:

Customization: With a new home, you have the ability to customize and personalize the space to your liking, including choosing finishes, colors, and layouts.

Energy Efficiency: New homes often come with energy-efficient features, such as double-pane windows, modern insulation, and energy-saving appliances, which can save you money on utility bills.

Warranty: New homes usually come with a warranty that covers defects and repairs for a certain period of time.

Low Maintenance: Since everything in a new home is brand new, there is less need for repairs and maintenance in the early years.

Cons of buying a new home:

Cost: New homes are often more expensive than pre-owned homes due to the cost of land and construction materials.

Location: New homes are often built in new developments, which may be further away from established neighborhoods, schools, and other amenities.

Lack of Character: New homes may lack the charm and character of older homes, which may have unique architectural details and historic features.

Pros of buying a pre-owned home:

Affordability: Pre-owned homes are often less expensive than new homes, especially if they require some updates or renovations.

Established Neighborhoods: Pre-owned homes are often located in established neighborhoods with mature trees and amenities like parks, schools, and shops.

Character: Pre-owned homes often have unique features, such as original hardwood floors, fireplaces, and architectural details, that give them character and charm.

Cons of buying a pre-owned home:

Repairs and Maintenance: Pre-owned homes may require more repairs and maintenance, especially if they are older and have not been well-maintained.

Lack of Customization: Pre-owned homes may not be as customizable as new homes, and you may have to live with features that you do not like.

Energy Efficiency: Pre-owned homes may not have the same level of energy efficiency as new homes, which can result in higher utility bills.

Ultimately, the decision to buy a new or pre-owned home depends on your priorities, budget, and personal preferences. It is important to consider all factors and work with a reputable real estate agent to find the right home for you.

Buying a house can be an exciting but complex process that involves many legal requirements.

Buying a house can be an exciting but complex process that involves many legal requirements. Last week’s scheduled economic reports included readings on inflation, the Fed’s Federal Open Market Committee meeting, and Fed Chair Jerome Powell’s press conference. Weekly readings on mortgage rates and jobless claims were also published.

Last week’s scheduled economic reports included readings on inflation, the Fed’s Federal Open Market Committee meeting, and Fed Chair Jerome Powell’s press conference. Weekly readings on mortgage rates and jobless claims were also published. Creating a household budget can be a helpful way to track your spending and ensure you are meeting your financial goals. You will need to examine your fixed expenses that are the same each month, such as rent or car payments and your variable expenses that change each month, such as groceries or entertainment. Dealing with debt can be challenging but incorporating it into your budgeting strategy can help you regain control of your finances. Here are some steps you can take to effectively manage your debt while budgeting:

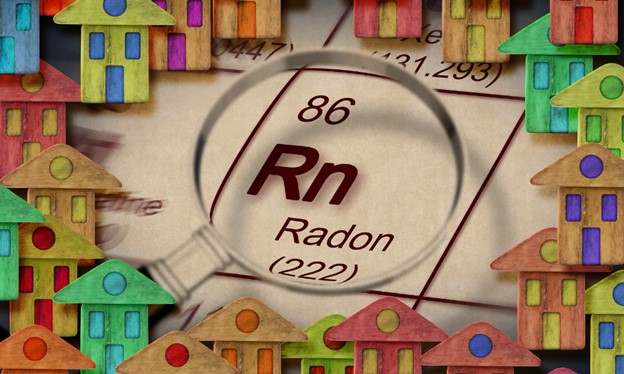

Creating a household budget can be a helpful way to track your spending and ensure you are meeting your financial goals. You will need to examine your fixed expenses that are the same each month, such as rent or car payments and your variable expenses that change each month, such as groceries or entertainment. Dealing with debt can be challenging but incorporating it into your budgeting strategy can help you regain control of your finances. Here are some steps you can take to effectively manage your debt while budgeting: The most important reason to check for dangerous home issues is to ensure the safety of you and your family. Leaving home issues unchecked can cause significant damage to your property and if you’re planning to sell your home in the future, it’s important to ensure that it’s free of dangerous issues that could affect its value.

The most important reason to check for dangerous home issues is to ensure the safety of you and your family. Leaving home issues unchecked can cause significant damage to your property and if you’re planning to sell your home in the future, it’s important to ensure that it’s free of dangerous issues that could affect its value.