How Mortgages Compare To Other Loans

Planning to buy a home, finance a car, or cover unexpected expenses? Many loan options exist to help you achieve your financial goals, but choosing the right one can be challenging. Here’s a breakdown of the most popular types of loans, their unique characteristics, and what you need to know to make the best choice for your financial future.

Planning to buy a home, finance a car, or cover unexpected expenses? Many loan options exist to help you achieve your financial goals, but choosing the right one can be challenging. Here’s a breakdown of the most popular types of loans, their unique characteristics, and what you need to know to make the best choice for your financial future.

Different Types of Loans

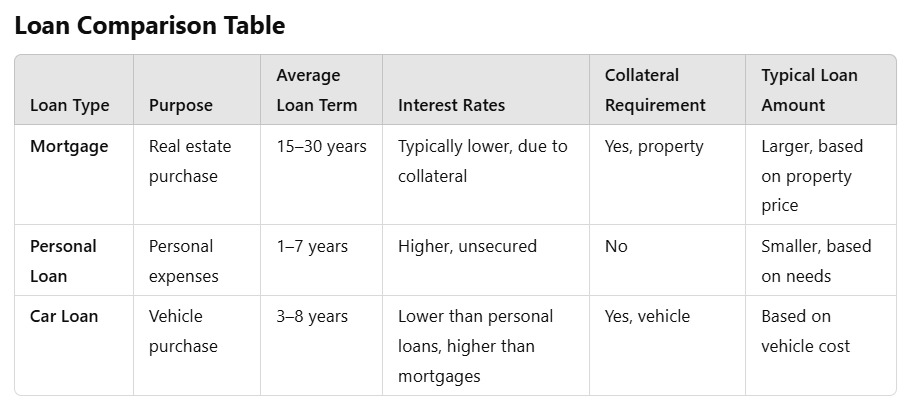

There are several types of loans, each designed to meet different needs:

- Mortgages: Secured loans used for purchasing real estate. Mortgages typically come with lower interest rates and extended terms (15–30 years) because they use the property itself as collateral.

- Personal Loans: Unsecured loans commonly used for expenses like debt consolidation, home improvements, or travel. Personal loans usually carry higher interest rates and shorter terms (1–7 years) because they don’t require collateral.

- Car Loans: Secured loans for purchasing vehicles. Like mortgages, car loans use the vehicle as collateral, often resulting in lower interest rates than unsecured loans, with terms of 3–8 years.

What Makes Mortgages Unique?

A mortgage is specifically designed for real estate purchases and typically has a longer term (15–30 years) than other loans. Unlike personal or car loans, a mortgage uses the property being purchased as collateral. This results in lower interest rates but involves a more detailed application process and a larger financial commitment. Mortgages are the go-to option for anyone looking to own property.

Types of Mortgages

There are several mortgage options available, each with different benefits:

- Fixed-Rate Mortgages (FRMs):

- Interest rate remains the same throughout the loan term, offering stable monthly payments.

- Ideal for long-term homeowners.

- Adjustable-Rate Mortgages (ARMs):

- Interest rate starts lower but fluctuates based on market conditions.

- Suitable for short-term homeowners or those planning to refinance.

- Conventional vs. Government-Backed Mortgages:

- Conventional Loans: Not government-backed, follow Fannie Mae and Freddie Mac guidelines, and require good credit.

- Government-Backed Loans: (FHA, VA, USDA) Easier to qualify for, often with lower credit requirements, making them accessible to first-time buyers or veterans.

How Personal Loans Differ from Mortgages

Personal loans are versatile and can be used for almost any purpose. Unlike mortgages, they’re unsecured, meaning no property or assets are required as collateral. While they’re easy to get, they’re less suited for major purchases like real estate due to shorter terms and higher interest rates. Personal loans are often used for debt consolidation, home improvements, or covering unexpected expenses.

Key Features of Personal Loans

- Unsecured: No collateral required, increasing accessibility but often resulting in higher interest rates.

- Flexible Use: Can be used for almost any expense, from medical bills to vacations.

- Quick Approval: Typically faster to approve than mortgages, with some lenders offering same-day approval.

- Fixed Interest Rates: Most personal loans have fixed interest rates and predictable payments.

- Flexible Loan Terms: Allows borrowers to choose a repayment schedule that fits their financial goals.

How Car Loans Differ from Mortgages

Car loans share one similarity with mortgages: collateral. However, they’re specifically for vehicles, with lower loan amounts and shorter terms. Car loans use the vehicle itself as security, typically resulting in lower interest rates than unsecured loans but higher rates than mortgages.

Key Features of Car Loans

- Depreciation: Vehicles lose value over time, so it’s important to consider a car’s depreciation rate before taking out a loan.

- Secured Loan: The vehicle serves as collateral, which generally lowers the interest rate.

- Interest Rates: Rates depend on credit score, down payment, loan term, and the vehicle’s age and type.

Understanding Loan Types

Choosing the right loan starts with understanding how each loan type works, including its purpose, terms, and impact on your finances. When considering a loan, factor in how much interest you’ll pay, how it will affect your credit score, and how it aligns with your long-term financial goals.

To ensure a smart financial decision, consider consulting a loan officer who can help navigate your options and align your choice with your financial goals. Whether it’s your first mortgage or an unsecured personal loan, make sure you understand the terms and requirements before signing.

If you’ve received your Closing Disclosure from your lender, congratulations! You’re almost at the finish line of your home buying journey, ready to celebrate with keys in hand. The Closing Disclosure, or CD, is provided at least three business days before your closing appointment and details your loan terms, projected monthly payments, and the much-discussed “cash to close.” But what exactly is “cash to close,” and how is it calculated?

If you’ve received your Closing Disclosure from your lender, congratulations! You’re almost at the finish line of your home buying journey, ready to celebrate with keys in hand. The Closing Disclosure, or CD, is provided at least three business days before your closing appointment and details your loan terms, projected monthly payments, and the much-discussed “cash to close.” But what exactly is “cash to close,” and how is it calculated? Retirement planning is about ensuring you have a steady income stream to support yourself comfortably. For many retirees, tapping into the equity in their homes becomes an attractive option. Two terms often come up in this context: reverse mortgage and Home Equity Conversion Mortgage (HECM). Although they are related, there are some critical differences between them. Understanding these options can help you make an informed decision about what suits your financial needs.

Retirement planning is about ensuring you have a steady income stream to support yourself comfortably. For many retirees, tapping into the equity in their homes becomes an attractive option. Two terms often come up in this context: reverse mortgage and Home Equity Conversion Mortgage (HECM). Although they are related, there are some critical differences between them. Understanding these options can help you make an informed decision about what suits your financial needs. You may have more options than you think when it comes to securing a mortgage for your new home. While many buyers opt for conventional financing, another option or program might be a better choice for you, depending on your personal and financial situation. Learning more about FHA, USDA, and VA loans ensures you get the best possible deal for your mortgage and that you secure the loan that you need for your new home. Here’s what you need to know about these useful mortgage options.

You may have more options than you think when it comes to securing a mortgage for your new home. While many buyers opt for conventional financing, another option or program might be a better choice for you, depending on your personal and financial situation. Learning more about FHA, USDA, and VA loans ensures you get the best possible deal for your mortgage and that you secure the loan that you need for your new home. Here’s what you need to know about these useful mortgage options. Accidents can happen from time to time, which is why it is important for people to have insurance. While you might be able to fix some accidents on your own, others can lead to a significant amount of financial stress. This is why people must have insurance. Insurance is supposed to help individuals and families pay for catastrophic expenses; however, what happens if the insurance policy is not big enough to cover the expenses? That is where umbrella insurance can be helpful. What is umbrella insurance, and how does it work? Learn more about how umbrella insurance might be able to help you.

Accidents can happen from time to time, which is why it is important for people to have insurance. While you might be able to fix some accidents on your own, others can lead to a significant amount of financial stress. This is why people must have insurance. Insurance is supposed to help individuals and families pay for catastrophic expenses; however, what happens if the insurance policy is not big enough to cover the expenses? That is where umbrella insurance can be helpful. What is umbrella insurance, and how does it work? Learn more about how umbrella insurance might be able to help you.